Case study II on systemic reforms

In the second part of our case study series on how a systemic approach can go a long way in reducing corruption, in extremely diverse scenarios, Pradeep Singh Kharola, Commissioner, Commercial Taxes in the Government of Karnataka, talks about the issue of statutory forms.

Technological intervention brought an interface that eliminated scope for corruption: In tax administration computer and communication technology was used to enable taxpayers to obtain certain forms (which have security features) at their doorsteps while at the same time the tax administration was enabled to capture vital details of the transactions.

Issue of ‘C’ forms Introduction: The problems of inter-state salesIndia is a federal country and the Constitution ensures free movement of people and goods between states. Taxation on sales of goods falls within the purview of the states, and each state has its own law to levy this indirect tax. The law provides that in case of movement of goods entailing movement across states, the state in which such movement originates is entitled to levy tax on the person (dealers) who despatches the goods. Since an indirect tax is ultimately borne by the consumer, there could have been a tendency on the part of states to levy a very high rate of tax on inter-state sales of goods with an intention of mobilising higher revenue since any such levy would have impacted the persons in other states and persons residing in the dispatching state would not have been put to any hardship. In order to obviate any such possibility, the law has prescribed a very low rate of tax (or concessional rate of tax) on inter-state sales. But there was also a threat that this concessional rate of tax might be misused by dealers by disguising intra-state sales as inter-state sales. Therefore it was necessary to have a mechanism to ensure that sales shown as inter-state sales actually reach the dealer in the destination state. Therefore, the law has prescribed that the receiving dealer has to confirm that such a transaction has taken place by giving a declaration that he/she has received such a consignment. In order to ensure that such declarations are accounted properly, the declaration has to be furnished in a pre-printed form supplied by the government. The declaration has to be filled in properly, giving all details, and dispatched by the consignee to the consignor (it is filled in triplicate). The consignor then furnishes this declaration to the office of the Commercial Taxes department and avails the benefit of the concessional rate of tax. The assumption is that once such a form is filled up and deposited by the consignor in the Commercial Taxes office, both the consignor and consignee would account the transaction and there would be no possibility of either evading the tax, as the Commercial Taxes department could verify the details filled in the form with actual transaction. Thus two purposes were intended to be served – firstly to give concession on tax on inter-state sale and secondly to reduce evasion of tax.

1.1. The problems with the old process:The blank declaration forms (C forms)- which have some security features – were issued by officers located all over the state in pads containing 10 forms. There is a huge demand for such forms throughout the year. The magnitude of the demand can be judged from the fact that in a state there are about 25000 dealers which have inter-state transactions and the number of lorry loads each state despatches for inter-state sales range from 5000 to 10,000 per day. Since these forms had certain security features their distribution was regulated. As a result, the dealers had to spend long waiting hours in the offices of Commercial Taxes and sometimes had to offer bribes. Moreover, the idea of issue of these forms was to ensure that both the consignor and consignee would account these transactions and the states would get their dues on these taxes. But in practice, the magnitude of physical work involved in any such cross-verification was so high that such cross-verification's were seldom resorted to. Thus, the existing system put the dealers to hardship on the one hand and also did not help the department in preventing tax evasion.

1.2. A web enabled system for monitoring inter-state transactions

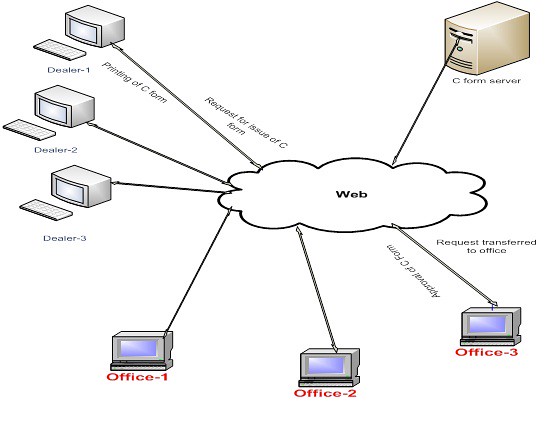

In Karnataka a web enabled system was designed, wherein each dealer was given a unique username and password. Apart from a Centralised server, offices in all important cities were networked. The dealer would access the Commercial Taxes department server through the internet and fill all the particulars which were required to be filed in the ‘C form’. The server would redirect the request to the concerned officer. On receipt of the information on his/her computer, the officer would scrutinize the request, and if all requirements are complied with, the officer would give permission to issue the form. The permission would enable the dealer to print the ‘C form’ at his/her place. This ‘C’ form would have all the data pre-filled and the Commercial Taxes Department would have captured all the details of the transaction thus forcing the dealer to account them accurately.

1.3. Issue and verification of forms became automaticWhile the server would allow the dealer to print the form, it would also transfer the particulars of the transaction to the account of the dealer. Thus the dealer would have no choice but to account the transaction thus totally ruling out any chance of tax evasion. Moreover, all details of the ‘C form’ thus registered would be placed in the public domain. As explained earlier, the ‘C form’ has to be dispatched by the consignee to the consignor. If the Commercial Taxes Department in the consignor’s state had any doubt about the ‘C form’ they would easily log on the web-site of the Karnataka Commercial Taxes Department website, and verify the veracity of the ‘C form’ submitted to them. In the past when the conventional system was in place, any such verification of ‘C-forms’ submitted by the consignor would have required dispatching a team officers from the consignor’s state to the consignee’s state who would then go to the office which issued the form, or contact the consignee to verify the correctness of the form. All this being time and resource consuming was hardly resorted to.

1.4. A win-win situationThe system has been in place for 4 months and already the number of forms issues per day has reached 4000. The taxpayers’ communities have received the system very well.

1.4.1.Benefits to tax payers: i.The tax payers do not have to make rounds of offices of the Commercial Taxes Department. ii.There is no question of bribing any one or giving ‘speed money’. iii.Loss of C-form does not entail any hardship as another copy can be obtained easily. (in the earlier system, loss of ‘C-form’ had to be addresses with a very laborious and elaborate procedure. 1.4.2.Benefits to the Commercial Taxes department i.The accounting of transactions is automatic. ii.Pre-printed ‘C-forms; are totally dispensed with. No need to keep stock of such forms, no need of physically accounting them. iii.No possibility of tampering the ‘C-forms’ iv.Cross verification of ‘C-forms’ is a desk exercise rather than an elaborate exercise as in the past. 1.4.3.Future course of action-‘dematting of C-forms’ At present the C-forms have to be printed. But since the details are captured in a centralized server, printing of forms may be dispensed with. But this requires that all states reach the same level of e-preparedness. With other states catching up on computerization, this system may well be the pre-cursor of electronic recording of all inter-state transactions. Click here to read about Case Study I: Recruitment of Drivers - an idea that brought in objectivity